Key Takeaways

- Staking allows cryptocurrency holders to earn rewards like interest by locking up their coins to help validate transactions. The more coins staked, the greater the rewards.

- Benefits of staking include earning passive income, gaining governance power on networks, and accessibility compared to mining. Annual percentage yields range from 5-15% typically.

- There are different types of staking such as becoming a validator, delegating to a validator, pooled staking, liquid staking through providers, and using exchanges.

- Staking comes with risks like market volatility, smart contract bugs, and security threats. Following best practices like diversification and using hardware wallets can mitigate risks.

- Staking provides opportunities for both individuals to earn passive income and hedge volatility, as well as institutions to generate supplemental yields on crypto assets under management.

- As proof-of-stake networks grow, staking will play an important role in decentralization and security while rewarding participants. It allows crypto holders to put their assets to productive use.

Introduction to Cryptocurrency Staking

Cryptocurrency staking has become an increasingly popular way for cryptocurrency holders to earn rewards on their digital asset holdings. But what exactly is staking and how does it work?

Staking cryptocurrency is similar to earning interest on a savings account. When you deposit money in a traditional savings account at a bank, the bank puts your money to work by lending it out to others. In return for allowing the bank to use your money, you earn a percentage of interest on your deposit.

Staking cryptocurrency works in a similar way. By locking up your tokens in a cryptocurrency wallet or pool, you give permission for the network to put your tokens to work validating transactions and securing the blockchain. In exchange, you earn a percentage of rewards on the tokens you have staked, like earning interest. The more tokens you stake, the greater your staking rewards.

Beyond earning rewards, staking gives holders the power in governing blockchain networks through voting rights. The more tokens staked, the greater voting influence users have.

Benefits of Staking

After the Shanghai Update in April 2023, Ethereum has transitioned to POS, which means staking will become the primary way to earn yields on cryptocurrency holdings.

There are several key benefits that make staking an appealing yield-earning strategy:

- Passive Income: Staking allows holders to earn passive income in the form of rewards similar to interest or dividends. Staking yields currently range from ~5-15% APY for major POS coins, a far more lucrative return than traditional savings accounts.

- Governance: Beyond earning rewards, staking gives holders power to influence governance and decision-making on blockchain networks. By staking coins, users gain voting rights on network changes based on the size of their stake. This empowers everyday users in decentralizing crypto networks.

- Easily Accessible: While mining still offers potential for higher rewards, it requires far more technical know-how and has high equipment and electricity costs. Staking simply relies on holding funds in a crypto wallet, making it accessible for everyday holders.

Hypothetical Staking Scenario

Jason is a 28-year-old software developer who began acquiring ETH in 2018 after learning about Ethereum's technology and potential. Over the years he accumulated 32 ETH through purchases and work paid in crypto.

In 2023, Jason decided to stake his ETH holdings to earn yield rather than just speculating on the price. He set up a validator node by staking the required 32 ETH in his own DeFi wallet app and kept it running through a cloud server.

After Ethereum's merge to proof-of-stake, Jason began receiving staking rewards for his validator of around 5-6% APY paid in ETH. He also participated in governance votes using her staked ETH.

Within 3 months, Jason had earned 0.4 ETH in rewards, worth about $640.

Jason is very happy with her staking returns compared to keeping ETH idle. The hands-off passive income complements her work earnings nicely. She plans to continue running her validator while potentially increasing her staked amount if she acquires more ETH.

Overall, staking Ethereum provides Sara with extra income and influence in the ecosystem while securing the network - a big win for a long-term holder.

Types of Staking

There are different ways you can perform staking, let’s dive right in!

Becoming a Validator to Stake

To become a validator under POS blockchains, you must stake your coins to directly participate in block production. Running a validator node demands technical expertise, dedicated hardware, minimum staked assets of 32 ETH, and 24/7 uptime. Validators create blocks and validate others, with accountability for errors. Staking as a validator has higher rewards but risks slashing penalties for violating protocols.

Delegate your Stake

Rather than running your own node, delegated staking lets you partner with a validator to earn rewards, minus a small fee, without the operational overhead. Delegating simplifies staking participation with less risk than validating. You entrust assets to a 3rd-party validator who handles securing the network. While validator rewards are higher, delegating reduces risks and commitment for a fraction of the return.

Pooled Staking

Another option when you do not have time or resources to become a validator yourself is using pooled staking. Pooled staking enables combining smaller amounts of crypto together via a pool operator to increase chances of rewards. Low barrier to entry with liquidity.

Liquid Staking

There has been a rising trend in tokenizing representations of staked assets (Liquid Staking Derivatives, LSD). Such providers are platforms like Lido, Rocket Pool, and Stakewise, which allows users to continue reaping staking rewards while keeping funds accessible. Users receive liquid tokens (stETH) pegged to their staked assets (ETH). There are many benefits to liquid staking, such as no lock-ups or minimum deposits, receiving staking rewards in real-time, and the ability to use staked tokens across the DeFi ecosystem to compound rewards.

Using CEXs to Stake

Centralized crypto exchanges like Binance and Coinbase have now been providing staking services. While convenient, staking on exchanges carries risks because “Not Your Keys, Not Your Coins”. The decision depends on your comfort with security tradeoffs. Staking through an exchange is easy and convenient but it outsources control over assets. Self-staking takes more effort yet keeps coins in your possession. Evaluate your preferences and risk tolerance when choosing between the two. Check out Cobo’s range of wallet solutions that uses MPC technology to split private keys into encrypted shares distributed securely among multiple parties, eliminating single point of failure.

Staking Rewards

Staking is a good option for investors interested in generating yields on their long-term investments and aren’t bothered about short-term fluctuations in price.

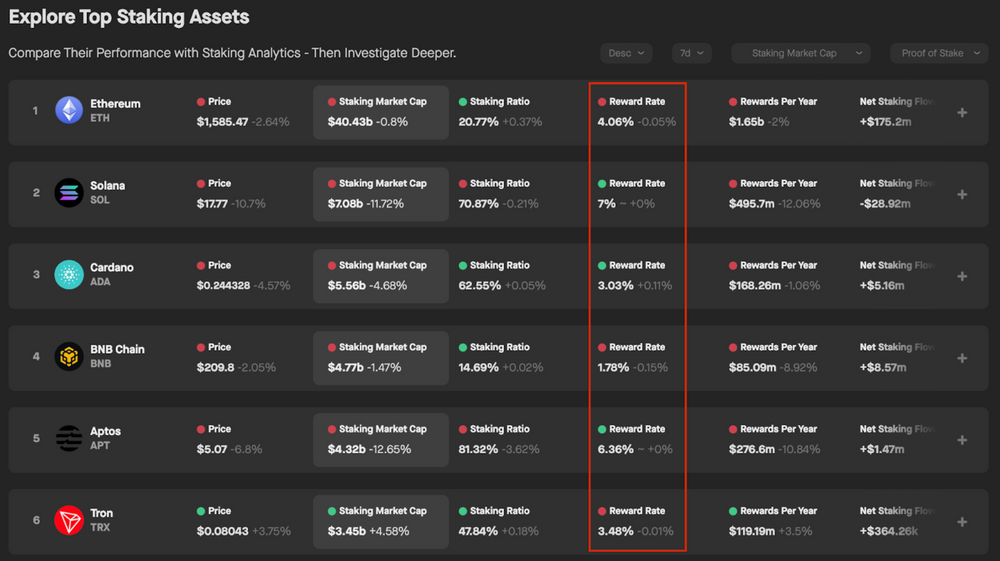

According to data, the average staking reward rate of the top 6 staked assets surpasses 4% annual yield. To put into context, staking 10 ETH will reward you with 0.4 ETH after a year. It’s important to note that staked rewards can change over time.

Fees also affect rewards. Staking pools deduct fees from the rewards for their work, which affects overall percentage yields. This varies greatly from pool to pool, and blockchain to blockchain.

You can maximize rewards by choosing a staking pool with low commission fees and a promising track record of validating lots of blocks. The latter also minimizes the risk of the pool getting penalized or suspended from the validation process.

Risk and Considerations

Market Risk

When you stake Crypto, the biggest risk for investors is that the price of the asset you have invested in may fall. This could cause you to lose money even if you earned a good interest rate. For example, if you were earning 15% APY for staking an asset and its value falls 50% in a year, this will lead to a significant loss of your money. Therefore, investors should be careful while choosing which asset to stake. Avoid overexposure to high-risk assets when staking.

Technical Risk

Staking comes with technical risks like bugs, hacks, and errors. Smart contract risks could lead to slashing of staked assets or loss of rewards. Failure to follow proper procedures may result in staked assets becoming stuck or lost. There is also a risk of your staked assets being hacked or stolen if you use exchanges or wallets with poor security features. Take precautions like using hardware wallets, and wallets with no single point of failure such as multisig wallets and MPC wallets. Also, users will need to stay updated on protocol changes and be prepared to unstake assets if major vulnerabilities are identified.

Security Best Practices

- Diversify across assets and protocols - Avoid overexposure to any single staking protocol or asset.

- Use hardware wallets or cold storage- This keeps staked assets offline and inaccessible to online attacks.

- Use multisig wallets / MPC wallets - Requires multiple sign-offs for transactions, preventing unauthorized unilateral transfers and eliminating single points of failure

Opportunities for Individuals and Institutions

For individuals

Staking offers passive income on holdings, network participation through governance voting, compounding returns, and volatility hedging. It allows broader cryptocurrency engagement beyond mere speculation.

For institutions

Staking means supplemental yield on assets under management and new revenue streams. Back then, mining was the only preferred way to generate yield in crypto amongst traditional institutions with large funds. Now, institutions have the option to earn yields directly with their own cryptocurrency wallets. Staking also enables institutions to support promising new crypto networks and assets they believe have growth potential. The public display of staking participation heightens institutional visibility and cements alignment with decentralized protocols and communities. Additionally, staking crypto may provide attractive risk-adjusted yields compared to traditional fixed income products in today's low rate environment. Custodial solutions providers can capitalize on demand for staking services by offering secure custody and management solutions to institutions seeking passive yields on crypto holdings.

Staking with Cobo Argus

Cobo Argus provides a platform for DeFi management such trading, lending, farming (“advanced” staking), and custom bots. Users can automate on-chain tasks like monitoring, alerts, token swaps, farming rewards, and liquidity management.

As more institutions look to put their crypto to work, staking presents a great option for earning stable rewards while supporting blockchain networks. This easy, low-barrier method allows cryptocurrency holders to earn passive income while securing POS networks' decentralization. As POS blockchains continue gaining prominence, staking will play a pivotal role in decentralizing and securing these networks while rewarding participants.

At Cobo, we are committed to build state-of-the-art, holistic custodial solutions in meeting and exceeding industry benchmarks in technological innovation, security, privacy and availability. Curious about Cobo’s DeFi Management Platform, Argus? Click here now to find out more!